It's no secret that insurance for carsharing continues to be a problem for operators. Now Zipcar's "little secret" about its insurance coverage has come out in the open - of the blogosphere, at least. FelixSalmon has done the entire carsharing industry a favor making this public in two long posts to this blog.

The issue is how members are covered by Zipcar's insurance. It would appear that the coverage Zipcar actually provides is little different than what rental car companies offer - state minimum liability-only coverage. My attitude is that Zipcar can offer whatever they want to offer, but they shouldn't disguise what they're doing.

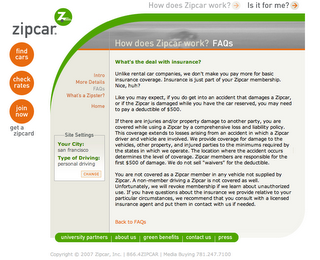

Zipcar's explanation on their website of how their insurance coverage works starts out trying hard to distinguish themselves from rental car coverage:

"Unlike rental car companies, we don't make you pay more for basic insurance coverage. Insurance is just part of your Zipcar membership. Nice, huh?"

But the heart of the matter on the Insurance web page is the following statement:

"We provide coverage for damage to the vehicles, other property, and injured parties to the minimums required by the states in which we operate."

As anyone who's ever owned or rented a car knows, these state minimums are laughably low - not what most Zipcar members have (or would have) on any personal vehicle they owned, I'll bet. Caveat emptor. The full text of the page is posted in first comment below.

What's most surprising to me about this whole thing is that Zipcar's competitors have not made very much of a big deal about the fact that DO provide much better insurance.

So if you enjoy a good mystery story, click on the FelixSalmon link (above) to read the full blog postings, including a response from Zipcar management.